Contact me if you have a similar task.

Contact me if you have a similar task.

Nimbo is an expert in company valuations. The enterprise advises companies worldwide on company acquisitions and sales and makes qualified, data-based estimates of the equity value of a company.

|

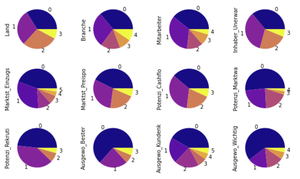

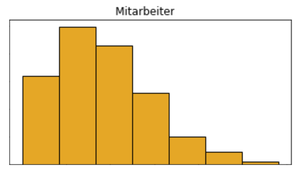

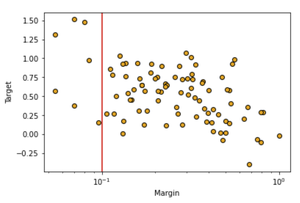

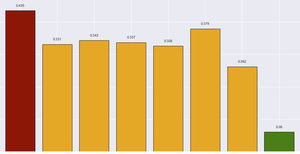

Originally, Nimbo restricted itself to conventional inferential statistics models to estimate the equity value of a company, based on company figures and questionnaire statements. At the same time, it was important to monitor the relative strength of the various influencing factors (feature importance). In so doing, Nimbo used its in-depth domain knowledge to create these models. With the help of a comprehensive exploratory data analysis (EDA), we were able to show that various methods from the field of machine learning (ML) should significantly improve the performance of the models. In fact, applying these techniques showed that ML regularization techniques as well as controlled feature selection and non-parametric ML models significantly improved equity value predictions. The task is a classic ML regression task, embedded in the accompanying processes from data management (DM) to exploratory data analysis (EDA) and feature engineering (FE) to eventually formulating the adequate ML models with the corresponding hyperparameters. By contrast there are other tasks in the area of supervised learning, such as image classification. |

Contact me if you have a similar task.

Contact me if you have a similar task.